Are you a female entrepreneur starting or thinking of starting your own business? Any business coach for women will advise you to always be ready with sound financial planning. Every business has its risks, after all. And any business, no matter how fool-proof you believe it to be, is a potential for failure if not managed properly.

So, what is financial planning? And how can you make the most of it to properly manage and handle your business?

One of the most important, but sadly often overlooked by female entrepreneurs when running a business is financial planning. There could be many reasons for this:

– Not realizing how important it is

– Not having an idea where to start and how to do it

– Just do not want to be bothered with the task of creating it

No matter what the reason is, it isn’t going to be good for business.

Financial planning and analysis help you see the bigger picture of your business. It guides you in setting both long-term and short-term goals with regard to your finances. It’s a major determining factor of whether your business will fail, survive, or in the best case, thrive.

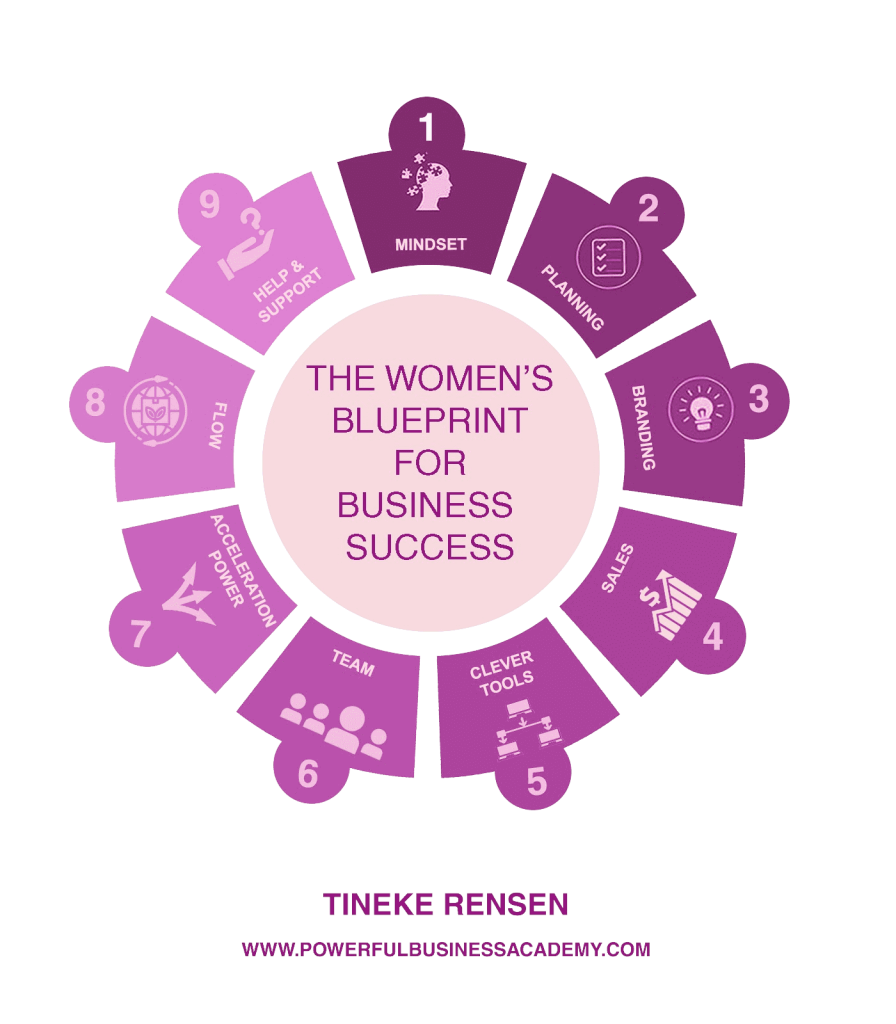

However, financial planning alone cannot guarantee business success. In total, there are 9 major areas in your business that you need to work on if you want to seriously scale and grow. Financial planning is part of Area 2, Planning. Learn about all the other areas in the system I created, “The Women’s Blueprint to Business Success.”

Unfortunately, though, 60% of female entrepreneurs neglect their financial planning. So, it should come as no surprise that about 35% of them have less than 25,000-euro turnover. You can’t call that business, can you?

Financial planning isn’t that hard if you have all the information you need. To start, there are 3 things that you should know before you start planning your finances:

Not a lot of women are good with finances, so they resort to hiring a bookkeeper. This is totally fine, as long as you are still aware of what your numbers are. A bookkeeper can record transactions and produce financial reports, but these data are futile if the businesswoman does not know how to understand and analyze them.

The first step in financial planning is knowing your turnover in the previous year. You would need to know:

Your bookkeeper most probably already has a record of the previous year’s expenses. You just have to look at the overview to see:

If you sell different products or services, you should also consider:

Those are some of the expenses that you would have to consider when you’re in the process of financial planning in your business. Essentially, your expenses should be less than your profit. Weigh up your expenses and see where you could cut corners.

Lastly, you need to look at your productive months. Some businesses are seasonal, and every business has months that are likely to be better than the others. Take a good look at your financial report. How many productive months do you have? Divide your total turnover by the number of your productive months. This is your monthly target.

Every month, you need to make a minimum of your target to be on top of your finances. Check on this at least monthly to stay ahead of the curve. If you’re getting behind, you can make adjustments such as increasing your marketing efforts.

Now, this may seem like a lot of work, but trust me, you are missing out on your business advancement if you do not plan your finances. Plus, it also gives you a sense of control, along with knowing when you need to step up a little more

Many female entrepreneurs fail to do financial planning for reasons that are totally resolvable. Financial planning is an essential task that doesn’t have to be complicated. It starts with having complete awareness and understanding of your numbers. And from there, you can make the necessary adjustments in your goals and decisions.

As a business coach for female entrepreneurs, I understand how women may feel intimidated by finances. But my advice is this: knowing gives you control. And the more you are in control, the better your chances of steering your business to success.

And while you’re creating your financial plan, you should also look into the other important areas of your business. A business is a holistic entity, after all, and you need a holistic approach to make sure that everything is in sync. Learn about all the areas in your business you need to constantly work on in my system, “The Women’s Blueprint to Business Success.”

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert in many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

Tineke Rensen is in business for 29 years. She built an international Outdoor and Survival business from scratch and sold this after 22 years. Tineke was a national whitewater kayaking champion.

She now is one of the most all-round business accelerators you can find. There are very few topics she cannot help you with your business. Many people find it hard to believe when they hear this. How much do you think you know about a topic if you live it day and night for 28 years?

Tineke works with female business owners to grow to their full business potential. She uses her own system the “Blueprint for a Successful Business Makeover”. She is a women’s business coach.

Tineke is the author of “Maximum Business Growth For Women”

If you want to watch business videos with Tineke Rensen you can like the Powerful Business Academy Youtube Channel

info@PowerfulBusinessAcademy.com

You can call, email or send a direct message for a response.