The Best Client Onboarding Process for Female Entrepreneurs

So you want more clients… new clients, paying clients, preferably better-paying clients. This is something all businesswomen want, right? More clients mean more sales, more income, and more growth for your business. It’s pretty straightforward.

However, getting more clients has become like an enigma for many female entrepreneurs–– everybody wants it, but few are successful at it. Do you know why?

This is because it seems like a simple sales activity. But it’s actually a complex process that involves many areas of your business. If one of these areas isn’t set up correctly, it throws all the other areas off course, and you’ll find yourself struggling to close deals.

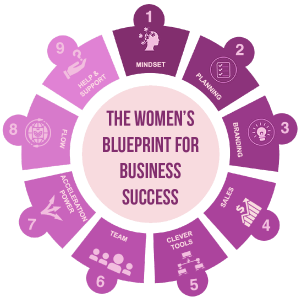

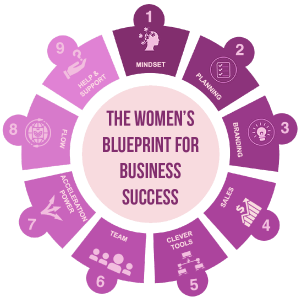

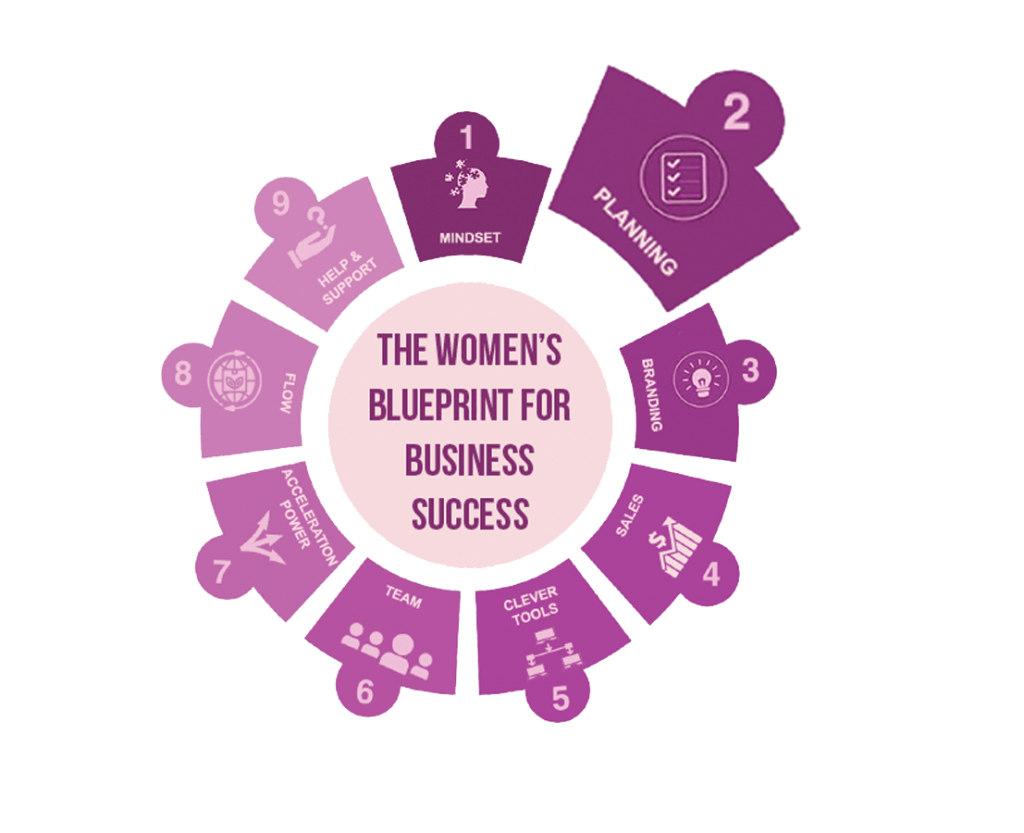

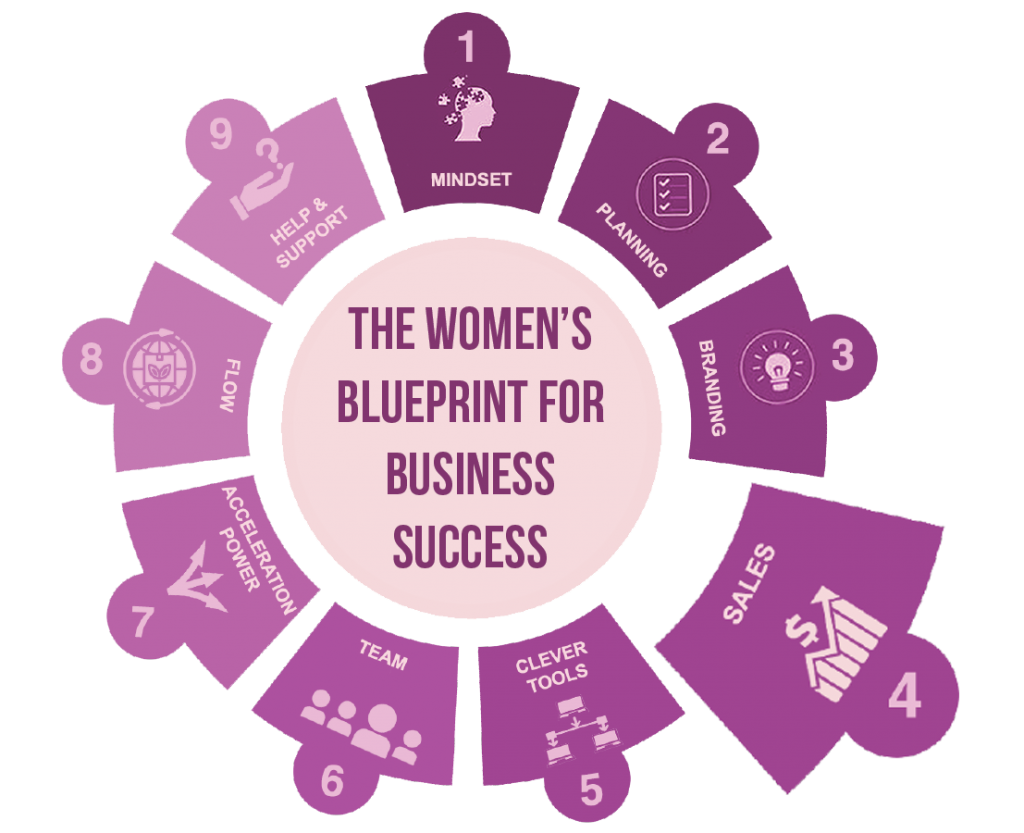

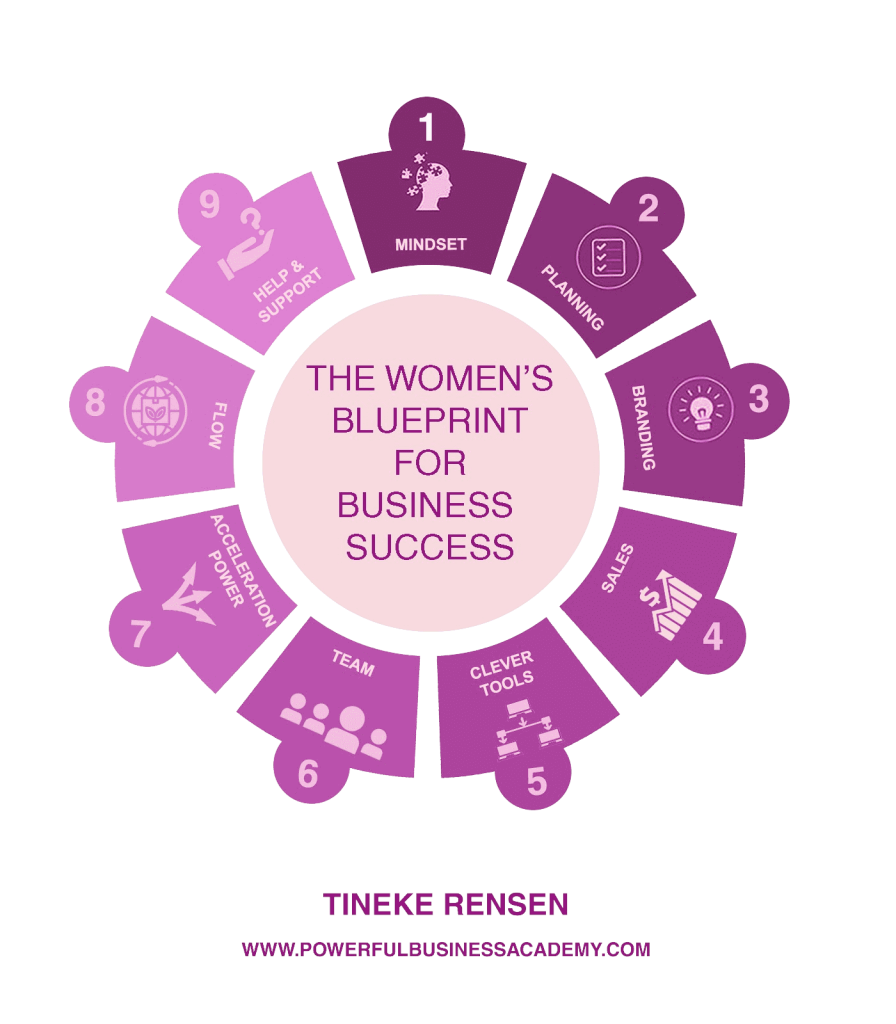

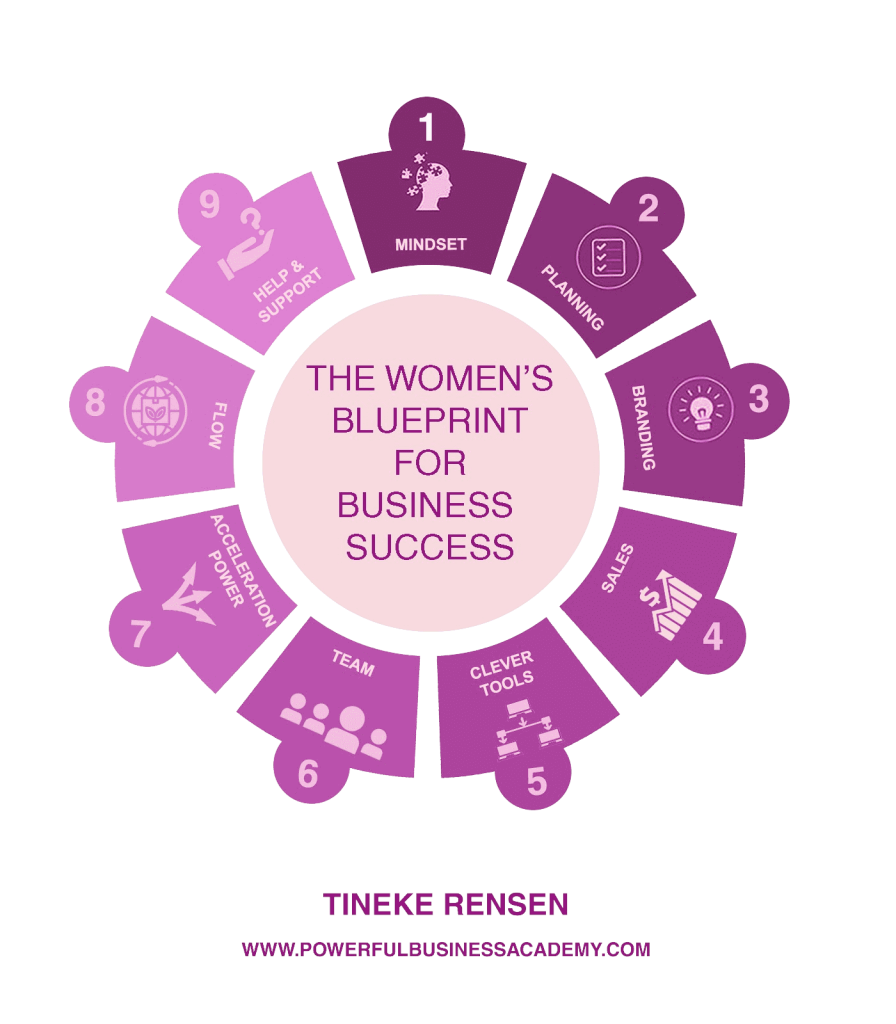

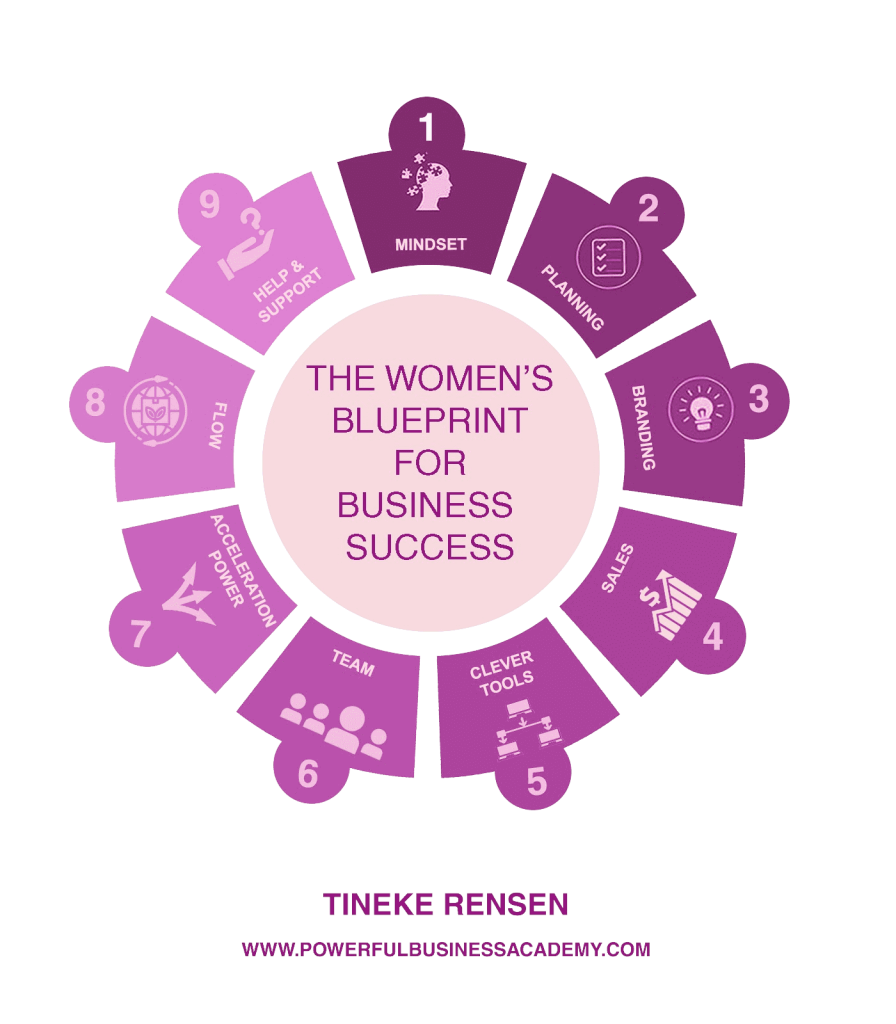

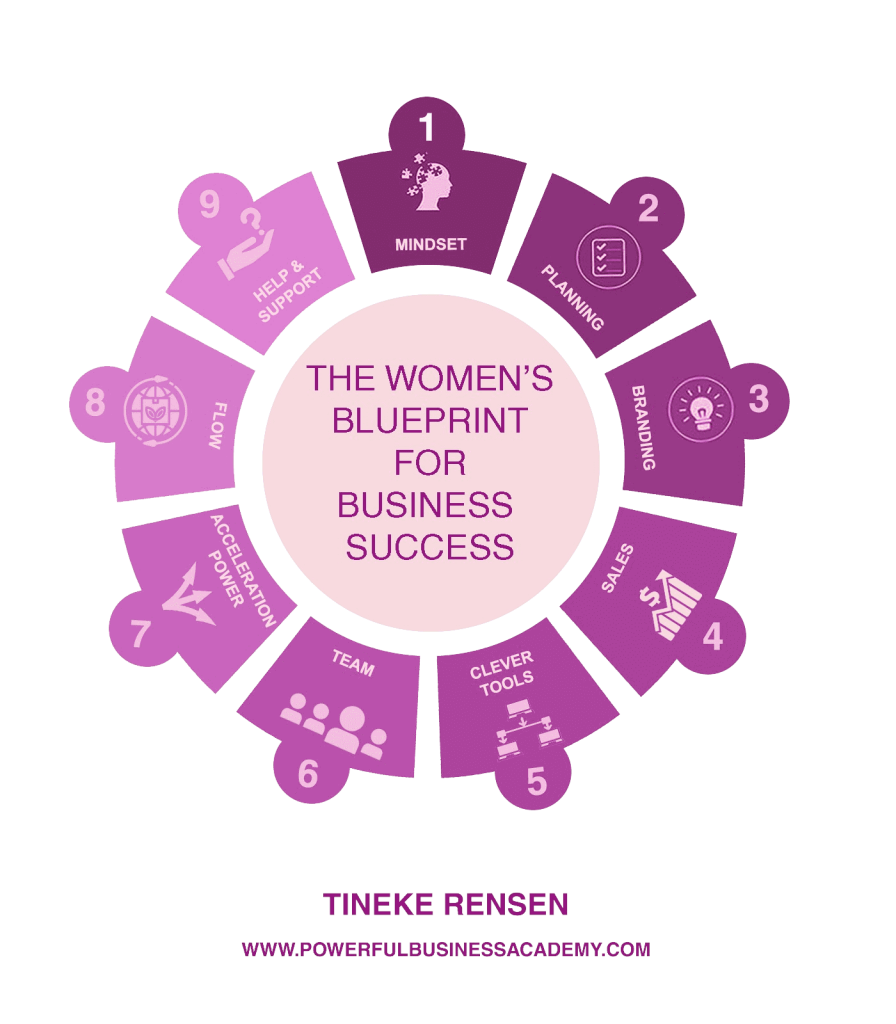

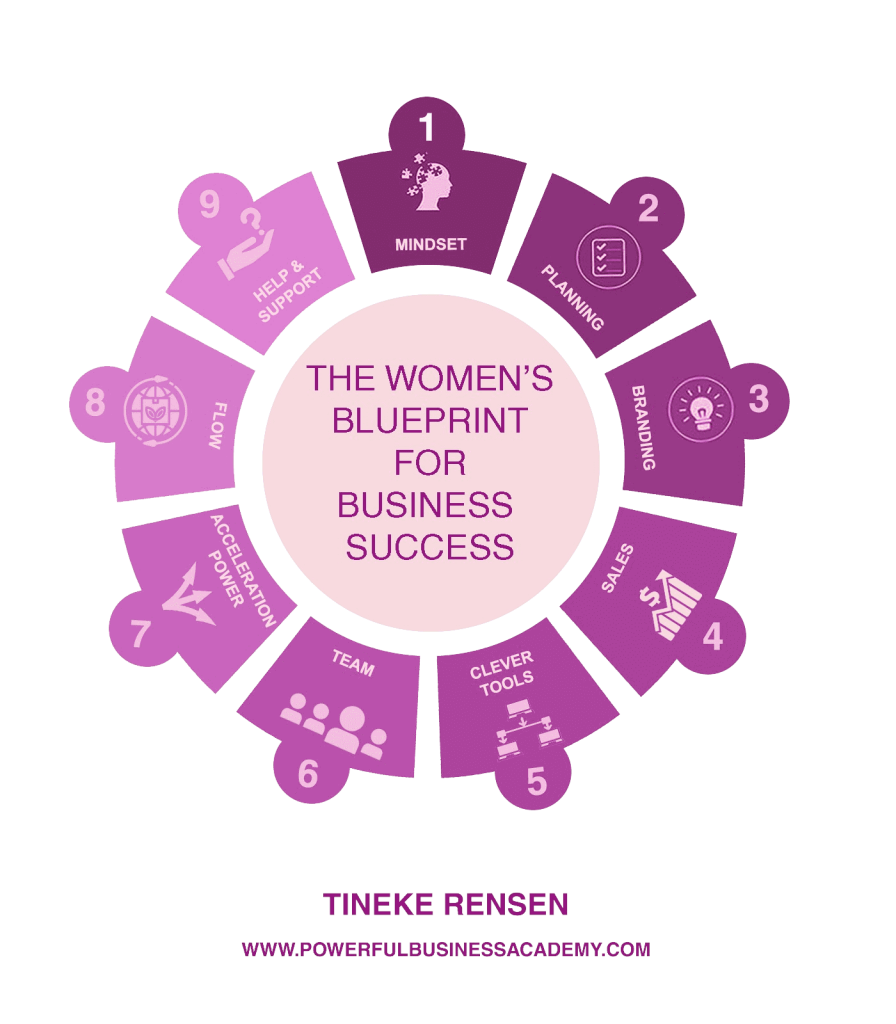

You see, getting more clients and growing your business is a holistic approach. It’s not just about one area. You need to work on all of them if you want to see the results you desire. I summed up all of these areas in a system I created, “The Women’s Blueprint to Business Success,” which you can check out here:

In this article, I discuss Area 1, Mindset; Area 3, Branding; and Area 4, Sales––how they all work together and what you need to take into account when you want to get new clients.

Knowing who your ideal clients are

First of all, you have to know who your dream clients are. When you want to have clients, but you don’t know who they are, it is like you are fishing with a tiny little rod in the vast ocean.

When you have narrowed all the variables of your dream client down to all the specifics, you’ll see that fishing will be a whole lot different. It will be like fishing in a small pond where the fish are eager to bite, because you have the right rod and the best food.

What you have to know about your ideal clients

You need to know your ideal clients before you can target them effectively. Think about these:

What is it that your dream clients are looking for?

What are their problems and their pain points?

How to position yourself towards your dream clients

Now that you know who your ideal clients are and what they need, how will they trust that you are the right person to go to? This is where the right positioning comes in.

What to offer your dream clients

You already know what your clients need, how will you serve them? What solutions will you provide?

Will you offer coaching or another service? How often will you meet? What do you teach in those meetings? Should you add extras (such as bonuses or freebies)?

How to price your offer

The packaging and pricing of your offer is very important. This is a make-or-break action, and you have to have the right package for the right price.

What strategies do you use here to entice your clients to become attracted to your offer?

How to you sell your service

A common limiting belief for businesswomen is that they are not good in sales. It then becomes something they don’t like to do.

Others who believe they are good in selling, on the other hand, are still faced with deciding what strategy to use and so on.

This is why knowing how to sell your service, whether you believe you’re good in sales or not, is still a critical skill that all businesswomen should have.

Here are just some of the things you should consider when you’re figuring out your sales strategy:

- Do you sell it online? If so, you need to have a sales page. How do you craft your page or sales page so that your dream client cannot say anything else but yes?

- Do you sell it in a call? For this, you need have to have a sales pitch.

Objection handling

Even when you have a client on the hook, there is still work to do to make sure that you close that deal. What if they say no? Do you just accept this answer or are you going to dig further and find out why they say no?

When objections happen, it means that your potential clients are not convinced enough. So they come up with a reason to not say yes to you now. What do you do to handle this?

Why having the right mindset is important

When you know for sure that whatever you sell is going to help your client, you are obliged to help them towards a buying decision. That is what selling is all about. Helping people to see why they need your offer, so they won’t remain stuck in wherever they are now.

It is not about pushing, convincing, pulling, persuading.

If that is how you see it, selling will be hard. If you can shift your mind towards the fact that selling is doing your ideal prospect a service, everything else shifts.

All these I mentioned above, it is called your dream client onboarding process.

And these are a lot of areas. There’s marketing, sales, mindset, branding, finance, positioning, copywriting, design, online marketing. Just to mention the most obvious.

Now all of that seems hard work when you do this with the masculine energy.

But when you initiate these actions with the feminine energy of abundance, trust, allowing and an inner knowing the universe steps in and will help you get the results you desire and deserve.

You don’t have to do it all on your own.

If there’s anything I learned in my 30+ years of business experience, it’s that the right help and support will propel you to greater heights. Having the right mentorship and encouragement will get you through even the toughest times in your business.

Wouldn’t it be amazing if you have a mentor and a business coach, plus a mastermind group that can teach you and give you more insight on your blind spots? Wouldn’t it be great to have a safe place to openly discuss your ideas so you can work not only on your business but on yourself as well?

This 3-Month Private Business Coaching Group is what you need

I created my new program exactly for this reason. If you feel like this is what you need to turn your business around, now is the perfect time to do it.

If you prefer to ask me directly, let’s have a quick chat here:

https://go.oncehub.com/15MinuteCallWithTineke

Summing it up

I’m sure there are many experiences we can learn from the past year. This new year, we can keep getting better by putting those lessons to use through our goals and business resolutions. The key is to be consistent––not only in one area of your business but in all areas. Your business is a holistic entity after all, and you need a holistic approach to scale and grow it. Learn more about my system, “The Women’s Blueprint to Business Success” here.

Check out our FB group for international self-employed businesswomen

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert in many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen is in business for 30 years. She built an international Outdoor and Survival business from scratch and sold this after 22 years. Tineke was a national whitewater kayaking champion.

She now is one of the most all-round business accelerators you can find. There are very few topics she cannot help you with your business. Many people find it hard to believe when they hear this. How much do you think you know about a topic if you live it day and night for 30 years?

Tineke works with female business owners to grow to their full business potential. She uses her own system the “Blueprint for a Successful Business Makeover”. She is a women’s business coach.

Tineke is the author of “Maximum Business Growth For Women”

If you want to watch business videos with Tineke Rensen you can like the Powerful Business Academy Youtube Channel

info@PowerfulBusinessAcademy.com

6 Tips to Help Female Entrepreneurs Stick to their Business Resolutions

Do you make new year resolutions for your business? Many of us make personal resolutions, but is it necessary to make ones for our business? Absolutely! Much like individual new year’s resolutions, business resolutions push us to accomplish more and reach our goals.

“Whether you think you can or think you can’t, you’re right,” Henry Ford once said. In other words, you often accomplish what you set your mind to and you measure up to the goals you set. That’s why new year business resolutions are so helpful.

There are also other ways you can make sure that you reach your goal of growing your business. Setting resolutions and goals are just part of that process. If you want to truly scale and grow your business, you need to work on 9 major areas. This article touches on Area 2, Planning, and Area 9, Help & Support. Learn more about the other areas in the system I created, “The Women’s Blueprint to Business Success.”

In my work as a business coach for women, I’ve found several effective ways to set new year’s resolutions for business owners and how they can stick with them.

1. The first step to setting new year business resolutions is evaluation

The goal of evaluation is to find out how your business performed throughout the year so you can adjust your plan accordingly. This will give you accurate data on which to base your future actions. Here are a few questions you can ask yourself:

- What strategies worked for you in the past year? What didn’t? How can you improve?

- What is the current status of your business? Where are you now?

- Where do you hope to be in a year?

2. Next, set goals and new year resolutions for your business

Now that you know what you want to achieve, what goals can you set to help you accomplish them? What can you change to improve your past performance? These can be general ideas such as delegate more, or more specific such as reaching a certain amount of income.

Here are a few examples of new year resolutions for you and your business:

- Delegate more frequently

- Prioritize work-life balance

- Create an engaging promotion plan for your business

- Learn a new skill

- Join a networking group

- Give back to your community

- Set a financial target or goal

3. Don’t just set new year business resolutions, plan appropriately

As they say, a goal without a plan is just a wish. If you want to accomplish your goals, you must have the tools and the skills to put them in action. What is it that you want to achieve? What are concrete ways that you can realize them?

For example, if you want to reach and convert more clients, what strategies can you use to generate more leads? How can you get your message out to a wider audience? What procedures can you put in place to make the process easier?

4. To help you keep your new year business resolutions, get group support

Getting the right help and support plays a great role in achieving your goals. Find peers, mentors, or a business coach for women who can help you become focused and keep you accountable. They will be there to guide you, motivate you, and support you along the way.

5. Break your goals and new year business resolutions into milestones

Are your goals too great that they overwhelm you? Break them down into smaller, more manageable targets. Being able to achieve what you set out to do, even little by little, will give you the momentum you need to keep going. It will also build your confidence and trust in the fact that you actually can achieve your goals.

And remember, when you are in action, you’re always going somewhere and opening yourself to new opportunities.

6. Finding motivators will push you to stick with your new year business resolutions

Keeping resolutions is not as easy as making them. In fact, according to Forbes, 80% of new year resolutions fail. And while there are many reasons for failing, there are still some things you can do to keep yourself motivated in accomplishing your resolutions. One thing you can do is reward yourself for each goal you achieve. Celebrate your wins with gifts for yourself, holidays, or anything else that will motivate you to keep going.

But while these external motivators work, having internal motivation is more important. What is the bigger picture for you? What do you value most? And What drives you? Knowing your purpose is the strongest incentive you can have. Having that mindset and being aligned with your goals will help push you through the challenging times.

Summing it up

I’m sure there are many experiences we can learn from the past year. This new year, we can keep getting better by putting those lessons to use through our goals and business resolutions. The key is to be consistent––not only in one area of your business but in all areas. Your business is a holistic entity after all, and you need a holistic approach to scale and grow it. Learn more about my system, “The Women’s Blueprint to Business Success” here.

Checkout our FB group for international self-employed businesswomen

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert in many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen is in business for 30 years. She built an international Outdoor and Survival business from scratch and sold this after 22 years. Tineke was a national whitewater kayaking champion.

She now is one of the most all-round business accelerators you can find. There are very few topics she cannot help you with your business. Many people find it hard to believe when they hear this. How much do you think you know about a topic if you live it day and night for 30 years?

Tineke works with female business owners to grow to their full business potential. She uses her own system the “Blueprint for a Successful Business Makeover”. She is a women’s business coach.

Tineke is the author of “Maximum Business Growth For Women”

If you want to watch business videos with Tineke Rensen you can like the Powerful Business Academy Youtube Channel

info@PowerfulBusinessAcademy.com

Do you have a list of business goals? If you’re a female entrepreneur determined to be successful in business, I’m sure you do. You might even think of yourself as “goal-driven,” too. You understand how important setting goals is to stay focused, dedicated, and enthusiastic in achieving positive results.

The process of goal setting, however, is not just about thinking of what goals you want to achieve. The real question is, how effective are you in setting the right kind of goals?

This is why many people use SMART goal setting when they want a strategic method of planning and laying out milestones to further their business. When you use this method, you set goals that are Specific, Measurable, Achievable, Realistic/Relevant and Time-Bound. It basically helps you identify goals that you are sure to achieve, setting you up for success. Sounds perfect, right?

Not exactly. While SMART goal setting is a good method in general, it’s not that effective for female entrepreneurs. At least not entirely. Especially when they are trying to scale and grow their business.

The SMART method focuses heavily on action and getting results. It’s a masculine technique for hyper-masculine business industry. And as a business coach for women, I advocate for a more feminine way of doing business. I believe that we women have innate traits that give us an edge in the business world, if only we harness these strengths and put them to use.

Before anything else, I want to emphasize that when you’re trying to scale and grow your business, goal setting is only one of the many areas you need to constantly work on. Your business is a holistic entity. Each part works with another, and each one affects the other.

For example, when you want to set the right goals, you also have to make sure that they are aligned with your mission, vision, and core values. These topics fall under Planning (Area 2), in the “Women’s Blueprint to Business Success,” an essential area of scaling and growing your business. If you want to learn more about the other areas, check out my system, “The Women’s Blueprint to Business Success.”

Now, going back, here are some reasons why you shouldn’t rely just on SMART goal setting when you want to be successful in business.

1. The SMART method doesn’t include feminine characteristics of setting goals

First of all, I’m not saying that the SMART method is inefficient. Far from it. Having focus and direction is important to achieving your goals. But these traits are masculine. And I believe that as women, we need to combine our own feminine traits, such as feeling and trusting.

In this male-dominated industry, we have been led to believe that emotions don’t have a place in business. I say no. Loving what you do and having a mindset of abundance goes a long way when you want to be successful.

2. Your goals shouldn’t just be SMART, you should be aligned with them

Feeling that alignment with your goals is another feminine trait that the SMART method does not consider when setting goals. When your goals are not aligned with who you are, with what your core values are, you won’t feel connected with them. But when they are aligned, you get that sense of purpose. You get that prosperous feeling where nothing can hold you back and everything lines up. Alignment brings positive energy and vibration, which is what you will attract in return.

3. SMART goal setting doesn’t encourage crazy ideas

SMART goal setting tells us to set goals that are realistic. But sometimes, when we’re inspired, we do get those crazy ideas. Grand or outrageous, but good ideas. Should we just set them aside for average and safe ones then? I don’t think so.

Let’s face it, having crazy ideas brings wonder and excitement. If you think to yourself, “Oh this is foolish, I can’t possibly do this,” you’re hindering your light and energy. Embrace your crazy ideas and attune yourself to them. Imagine yourself having already achieved them and act as if they already happened. This will train your brain and your vibration to be in an abundance state. And then combine this feminine trait with a masculine trait: taking action. Your crazy ideas will remain just that––ideas––if you don’t start doing something to achieve them.

4. You don’t always have to know exactly what your next steps are

So, you had a crazy idea and you started taking steps to achieve this goal––what’s next?

Expect things to come your way. Trust that even though you don’t know what’s going to happen, something IS going to happen to help you on the way to achieving your goals. When you set things in motion, a shift in energy happens, you gain momentum. That’s the beauty of action: something happens and there’s movement.

And you may not know exactly what happens, or where it leads to, but being present and attuned to your goals will help you make those adjustments as you go along. You can steer yourself in the right direction. You just need to be connected with your goals and trust that you’re the right person to deal with them.

5. It doesn’t take into account your energy when setting and achieving goals

I always say that your mindset and energy play crucial roles when you’re trying to achieve your goals. When you love what you do, when you’re in a state of abundance, when you’re in movement, many doors and opportunities will open up for you. When all of these align, the universe steps in, and coincidences happen. And these will bring you a lot closer to your goals.

6. It doesn’t look into the possibilities

If you’ve been following the SMART method of setting goals, you’ll find that you were taught to be pragmatic, to avoid risks. But isn’t that the beauty of aiming higher? To look beyond your supposed capabilities and wonder how far you can go?

Well, I say be curious. Think about the possibilities. Remember, you would not get the idea or the desire if you would not be capable of achieving this goal. And if you are connected with it, if you do something about it, you will.

Summing it up

The SMART method is a good method. But it’s incomplete. It only touches on one part of goal setting and completely ignores the energy part, the abundance part, and the universe part. As a business coach for women, I train my clients to be aligned with these feminine characteristics and integrate them with them the typical masculine traits of doing business. This is also why I came up with my system, “The Women’s Blueprint to Business Success.” It’s a holistic approach that deals with 9 areas and 45 sub-areas of your business that you need to work on to achieve success.

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert in many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

What pricing strategy are you using as a female entrepreneur? Is it the right one for the product or service you offer? What factors do you include when you’re determining your prices? How can you use your pricing to maximize sales and profits, and beat the competition?

Developing a pricing strategy can be really tricky. There’s a lot to consider. On one hand, you want to have offers that are attractive to as many consumers as possible. On the other, hand you want to get as much profit as you can, too. How can you strike that balance?

As a business coach for businesswomen, and a businesswoman myself, I understand the crucial role of a good pricing strategy in scaling and growing your business. But I must say that it’s not the only thing you should focus on. There are many areas in your business that you need to work on if you want to be truly successful.

In my system, “The Women’s Blueprint to Business Success,” I address 9 areas in your business that you constantly need to tend to.

Employing a good pricing strategy is a subpart of Area 4, which is Sales. You must always look at your business as a holistic entity, and as such, you need a holistic approach to growing it. Learn more about it here.

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

Here are some tips you should consider when you’re developing a competitive pricing strategy.

1. When determining your price, make sure to charge enough to cover the costs and more

It goes without saying that when you’re determining your price, it includes the price of producing or performing your product or service––plus your profits, of course. But these aren’t the only factors you need to take into account when coming up with a pricing method. Here are a few more:

- If it’s a product, make provisions for the packaging and shipping costs

- If you’re selling online, take into consideration the costs of the systems that you use such as website hosting, payment methods, and so on

- Also include your budget for advertising and marketing, as well as research and design

2. Check the prices of your competitors when you’re creating your pricing strategy

One important factor that consumers consider when choosing which product or service to purchase is the price. And more often than not, people tend to choose that which has the lower price. Especially when they think that their options are of similar quality.

When you’re offering a service, this may not seem as significant because no two are exactly alike, and comparison is not entirely possible. The same is true when you have an offer that’s one-of-a-kind, something that no one else has. Then you can charge as much as you want.

For products, however, it’s a different story. If you’re selling a product that has many others like it in the market, consumers will be able to compare. And the more price-conscious ones are, the more likely they go for the products with a lower price. If this is the case, you can gain an advantage by offering a discount on a second product or offering an extra service so that comparing won’t be possible anymore. This will encourage more customers to go for your product, resulting in a higher volume of sales.

3. A value-based pricing system can be more effective

Value-based pricing is all about knowing how much your target customers are willing to pay for something that they value. It puts more focus on the customer than the cost of making the product or service. So knowing who your ideal clients are is essential when you’re using this pricing method. What do they like? How much are they willing to pay? When you know this, you will be able to adjust your prices accordingly.

To give an example of this pricing, sustainable or eco-friendly products have much higher prices, but environmentally conscious consumers will be willing to shell out that cash. Health-conscious consumers will pay more for organic produce and other healthier options. People who like unique pieces will spend more on custom-made items.

Customer experience also factors in when you’re using this pricing model. If you can provide an outstanding experience that they won’t find anywhere else, you can set a price that you believe is worth it. Define who your target audience is and learn what they want. When done right, a value-based pricing strategy will not only drive your sales up, it will also promote customer satisfaction and loyalty.

4. Tell a story

Another way you can set yourself apart from your competitors is by creating a story around your product or service. Consumer behavior is all about consumer perception. The more you are able to connect with your target audience, the more inclined they will be to purchase from you.

You can do this by creating a narrative that resonates with your target audience. What are their pain points? What design appeals to them the most? What words do they use? Knowing these kinds of information will help you know how best to communicate with them.

5. Never ask a price you don’t feel comfortable with

Asking high-end prices is what every female entrepreneur wants. This comes with an attitude that most women don’t have when they start their businesses.

When they can’t see, feel, or believe the value they are offering to their clients, it is very difficult for them to sell high tickets.

My tip is: Sell it for a price you feel comfortable with and raise it after selling it three times. This will help you build trust in your own selling capacities so the client can feel your confidence, and everything feels in alignment with your price.

6. What does it mean when everybody buys?

When everybody buys from you this can have 2 reasons.

- You can sell bloody good. For most women, this is not the case.

- Your prices are far too low. And that is most often the case for women. When nearly everybody buys from you it is a great indicator to know you need to raise your prices.

Summing it up

There’s a lot that you need to consider when determining which pricing strategy to use. As a female entrepreneur, you should ask yourself: How can I charge the best price so I can maximize my profits and grow my business?

To do this, you can’t just focus on your pricing. You also need to work on how you should brand yourself to set you apart from your competitors; how you can engage your audience and generate leads; how to position yourself so you can attract your ideal clients. Your business is a holistic entity, and as such requires a holistic approach. You can’t just work on one area and expect a drastic change. You need to work on all areas all the time. I know that’s not easy to do, especially if you’re a solo female entrepreneur. But you can always learn from an expert, a mentor, or a business coach for female entrepreneurs, such as myself. You can learn more about my system, “The Women’s Blueprint to Business Success” here, or schedule a quick 15-minute call with me here.

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

https://go.oncehub.com/15MinuteCallWithTineke

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

Do you use automation for your business? If you’re a busy female entrepreneur with an up-and-running business, chances are you’ll benefit greatly from it. You do want to save yourself time, energy, and money, right? And you don’t want to keep doing the same tasks over and over again, surely? This is where automation comes in handy. If you’re not yet using automation for your business, now is the time to start. And I’ll share with you some tips on business automation that I personally found useful as a business coach for female entrepreneurs.

Automation can work wonders for your business. But while it can help you out a lot in running your business, there are other areas that you need to work on so you can get the results that you want. Automation will not make a significant difference when you don’t have other systems in place, such as standard operating procedures, branding guidelines, and many others that make sure your business processes run smoothly and accurately. When you’re scaling and growing your business, you need a holistic approach that will address all areas of your business. For this reason, I came up with the system, “The Women’s Blueprint for Business Success.” Check it out here.

Automation is a sub-area of Clever Tools (Area 5), one of 9 areas addressed in “The Women’s Blueprint for Business Success.” In total, there are 45 sub-areas in the blueprint, all working together to help you run a successful business.

That said, here are some useful tips when you want to save time and money with business automation:

1. Automate recurring tasks in your business

When you’re running a business, there are many tasks that recur––they’re a big part of making sure everything runs well and on time. But do you really want to be doing all these yourself and do them every day for that matter? I don’t. I don’t like doing the same thing over and over again. Also, I don’t get energy from that. And I’ve talked about energy many times before and how important it is to radiate and vibrate positively. When you don’t like what you’re doing, that just won’t happen. You’d rather spend your time and energy on other areas that you love doing and that will make you money, especially when you’re a female entrepreneur. So, for tasks that need to be done daily, tasks that are administrative in nature, or tasks that you don’t like doing, the first thing you should look at is: Can I automate this? If you can, the best thing to do is automate them.

2. You can automate tasks in almost all areas of your business

Recurring tasks are mostly on the admin side of the business, but automation is not just for that. There are many different areas and different ways to automate your business. Aside from sending invoices and reminders, you can also automate your email marketing. For social media, you can automate the scheduling of your posts instead of posting each one yourself. You can even use tools for copywriting if you don’t want to spend a lot of time creating your content. Have proposals been signed off? You can automate that too. Scheduling calls and appointments? Yes, automate. If it’s a task that needs to be done regularly, in any area of your business, there most likely is an automation tool for it.

3. Automation is cheaper and more accurate

You’re probably wondering if you’re going to spend on automation, why not just delegate or outsource? Same outcome, right? Not exactly. If you compare the cost of outsourcing or hiring a VA to the cost of buying a business automation software, automation is definitely much cheaper. In fact, if you check out platforms such as Appsumo, there are lifetime deals you can purchase just one time without recurring monthly charges.

Automation also has the advantage of accuracy. When set correctly, it doesn’t make mistakes. Without the element of human error, it’s more reliable and will take less time to set up. If these are factors that are important to your business process workflow, you should definitely consider automation.

4. You don’t have to buy the full versions of automation tools

Purchasing the premium versions of business automation tools can indeed be pricey. But most often with your small business, you don’t really need all the features included in the full version, especially if you’re just starting out. So, before you buy premium, check out the inclusions. If you don’t need or won’t be able to use all these features for your business, the free or basic versions of the apps work just as well. And if your business grows and the time comes that you do actually need those features, you can upgrade.

5. You can always try business automation software before purchasing them

Not sure if you want or need an automation tool? Try it out first. Most, if not all, subscriptions nowadays come with a trial period and money-back guarantee. So, if you’re not ready to commit to a purchase, take advantage of the trial period to test out the app and see if it’s worth it. If not, cancel it and try out another one until you find the business automation software that works for your business.

6. Make sure that your business automation software works for your particular needs

Like I previously mentioned, there are many, many tools out there that offer good deals at affordable prices. But before you make that purchase, make sure that it works for you. Is it the right tool for your type of business, your location, or your clientele? How about the language or legislation in the country your business is operating in? These are just some of the factors you need to consider when choosing the right business automation software. For example, I use a Dutch bookkeeping tool that takes into account the Dutch VAT and tax. If you’re going to automate your business, look into these and do your research.

Summing it up

Business automation has become an indispensable part of scaling a business. Particularly in this current pandemic that we and our businesses are going through, it is an efficient way to save time, effort, and money. Automation helps us keep our businesses going no matter what.

But again, automation is not the only part of your business that you need to work on when you want your operations to run smoothly. Other components such as having SOP’s, financial plans, and even hiring team members to do what automation cannot, are all equally important when you’re scaling and growing your business. You need to be working on all these areas, nine to be exact if you want serious results. Learn more about these nine areas in my system, “The Women’s Blueprint to Business Success” here.

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

Do you have a mission, a vision, and core values for your business? If you’re only starting out as a female entrepreneur, or if you think your company isn’t sizeable just yet, you may be wondering, do you even need them at all? What are they for? What’s the difference among these three to begin with?

The importance of having a mission, vision, and core values has always been overlooked by many businesswomen. As a business coach for female entrepreneurs, I always ask my clients, “How do you see yourself in five or more years from now?” Some women have a general image of how they want their business to be, but many others don’t. When I ask them how they plan to achieve these goals, even more women are unable to define the steps they should be taking to achieve success. If you don’t know where you’re going, how will you get there? Will you even get there?

The condensed answer is this: your mission, vision, and core values allow you to see clearly what direction your business should take. With the business industry constantly evolving, it’s very easy to get lost in what’s trending, what’s profitable, or what’s easy. You need these guidelines to make sure that you stay on track and stay true to your intentions when you started your business.

Now, creating your mission statement, identifying your vision and discovering your core values are just part of one area that you need to work on when you’re trying to scale and grow your business. And there are many areas, with all of them interconnected. For instance, this part guides other areas of your business that are just as important, such as planning and goal setting. If you want serious results, you need a holistic approach that tackles all areas of your business. If you want to learn more about what these areas are, check out my system “The Women’s Blueprint For Business Success”

With this understanding of why your mission, vision, and core values are important to your business, here are some tips on how you can create ones that work for you:

1. Start by discovering your core values

Before you start creating your mission and vision, you need to know what your core values are. They are so essential that you need to know what they are before you even start any business. Your core values define how you want to live your life. Your business is a huge part of your life. As a business coach for female entrepreneurs, it’s the first thing I work on with a client.

Your core values depict what beliefs, principles, and standards you should live by. They are the essence and identity of you. How will you know them? Ask yourself what’s most important to you. Is it family, integrity, service, religion, friends, inspiration? There are hundreds of possible core values. How should a normal business day look like for you when you want to live every day according to your values?

When you know what your core values are, you should assess: Are you living by them? Because if your actions and decisions are aligned with your values, that’s what you radiate and vibrate. The law of attraction kicks in. And it sets off a force that will make your actions easier because you are in alignment with who you are. Miracles and coincidences start to happen. This alignment only starts when you know what your purpose is and when you work according to your values.

2. Your mission should be for a higher good

When you’re creating your mission, think about what your higher purpose is as a female entrepreneur. It’s not just about what you do or what you want to achieve. It’s more about who you are and what legacy you want to leave behind. And it’s not about the money. Legacy is never about the money.

In my case, I want my legacy to be this: make the business world become more feminine. I want my business to be about helping other businesswomen scale and grow their businesses. I want to help businesswomen create bigger businesses so I can fulfill my mission that the business world is not so masculine anymore.

Your mission is your why

Why do you do what you do? Why do you exist as a business? For whom do you do it and what are the benefits? You should ask yourself these when you’re creating your mission statement.

3. Your vision is about how you fulfill your mission

There are many various ways you can create your vision, but your mission gives it direction. For example, it’s possible to achieve my mission of a more feminine business world if I had gone into politics, or into charity work. But I chose to do it through my own business. So, your vision and mission may be different and not directly related, but they are connected. And when you know the vision and mission of your company, you’ll know what goals you need to set and what steps you need to take to achieve them.

I could’ve chosen many types of businesses to achieve my mission. I chose to be a business mentor. That’s what my vision is. So, when you create your own vision, think about how you want to achieve your mission. What business or industry do you go into so you can realize it?

4. Having a vision, mission, and core values are important even for small businesses

All large and successful businesses have their own missions and core values. And if it’s helpful for them, it can be as helpful for you too, no matter how big or small your business is. Having these are not just a formality, they are powerful guidelines that direct you towards your goals. If you have a mission and vision, you always know what to do. They give you focus.

Don’t be intimidated by them if you think that your business is still too small. They will actually give your audience a better understanding of who you are as a business. Your potential clients will be able to relate to you more if they know who you are and what you stand for. And they will be more likely to respond to you because they are able to connect with you.

5. Your mission, vision, and core values will attract more opportunities

I am a big believer of energy and vibration. If you love what you do and you’re in the right direction, your energy increases, and you attract many opportunities. And these opportunities, come in many shapes and sizes. Some will help you grow and thrive, but some will sidetrack you as well. If you know what your mission, vision, and values are, you will know which opportunities to take and which to turn down because they don’t serve you.

As a businesswoman and a business coach for businesswomen, I’ve been in this situation many, many times. Because one of my core values is to improve, I’m always tempted to say yes to every opportunity that comes my way. And I do want to learn more and get better, but I always check: is it in alignment with my core values and my mission and vision? If they are not, I move on. This creates the focus for me and my business.

Summing it up

If you feel lost and unsure about what steps you need to take as a female entrepreneur, going back and reflecting on your core values, mission, and vision will help you redirect your focus. They are not just for big businesses to tout, it’s for you to find guidance from, no matter where you are in your business.

If you don’t have your own mission, vision, and core values yet, it’s time to take a step back and think about who you are as a business and as a businesswoman. I’ve previously mentioned that this is only one part of growing your business, but it is still an important part. Because that’s how it is when you’re scaling and growing your business––you need to work on all areas. If you don’t have a strong mission, vision, and core values, your goal setting, and strategic planning will be all over the place too. Each area affects another, and they all work together. You can learn more about my holistic approach through my own system, “The Women’s Blueprint to Business Success.”

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

Having a healthy and functional work-life balance is hard for a busy businesswoman, right? More so if you’re working from home, or if you’re a working mom. It’s even harder when you’re a solo female entrepreneur. You have so many responsibilities, so many hats to wear, so many duties to take care of. How can you make sure you’re not neglecting your business, your family, and as equally important, yourself?

Work-life balance is a complicated topic for many female entrepreneurs. Add to that the burden of living through a pandemic where most of us are confined to working in our homes. In this kind of situation, it’s unavoidable that our family and work lives mix and impose on each other. Boundaries become blurred, which then throws off our focus and productivity. And you want to be focused. When you’re a parent, you want to focus on your children. But as a businesswoman, you also want to focus on your business.

So how do you draw the line? How can you keep that healthy separation between your own personal life, and that of growing your business?

Before anything else, I want to emphasize that scaling and growing your business requires work on all areas. Maintaining a healthy work-life balance is an important part, but it’s only one part. If you want to make a significant difference to your business, there are nine areas you need to be constantly working on. If you want to know what these areas are, I created “The Women’s Blueprint to Business Success” from my many years of experience as a business coach for female entrepreneurs. It identifies all the areas you need to improve when you’re growing your business. Learn more about it here.

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

Now here are some tips to consider if you want to have that good work-life balance:

1. Have a separate room where you conduct your daily business tasks

Having a separate room where you can close the door will help create that distinction between work and home. It will also minimize the disruptions that being at home naturally creates, especially if there are many people living in the same house. If having an entire room to yourself is not possible, you can use the space that’s available to you and make a partition. This will help you shift your mindset to concentrate on the work you have to do.

2. Treat your working day at home like it’s a day in the office

Separate your work duties from your personal ones by creating a clear division between the time you spend focusing on work and the time you spend on yourself and your family. Set specific hours that you would work only on your business. The rest of the time focus on everything else. This will help you be more focused in the now and increase your productivity as a female entrepreneur.

3. Enlist the support of your family and close circle when balancing work and family

Creating a delineation of work and family life is great in principle, but we all know that when you’re a full-time parent, this is easier said than done. Especially when you have young kids. Will you ignore your crying child? Will you disregard your child’s needs? Of course not. You’re a parent first, after all.

What you can do is to encourage the people in your household to give you their support while you work on your business, which is also just as important. When it’s your time to work, ask them to respect the fact that (as much as possible) you will not be available during that time. You can also have arrangements in place to ensure that your children will not be neglected during your work hours, such as daycare or having babysitters over.

And what’s wrong if they watch a movie so you can work in the meantime? When they are teenagers, they will do this anyway and you will have no say about it anymore. No matter how hard you’ve tried to get them away from the TV when they were young. I know from personal experience. L

4. Manage your time well to have a good balance between work and life

As women, we know that being a parent is 24/7. And as businesswomen, we also know that the work never stops. There’s always more work to do, phone calls we need to answer, emails we have to respond to––it’s never finished. That’s why you have to use your time well and focus on what you’re doing at the moment. We hear a lot about multitasking nowadays, but is it really effective? If you find that you’re not getting the results you want even when you feel like you’re doing so much, it’s time to reassess how you’re doing your tasks. Organize and schedule the tasks you need to do according to when you think it will be more productive for you to do so.

If you’re prone to procrastination, work on your self-discipline. I know it isn’t easy, but if you keep doing it, or at least try doing it, it will become a habit. You can also have accountability partners to motivate you and hold you responsible for accomplishing your tasks.

5. It’s okay to say no

Maintaining a work-life balance can also be more difficult when you have clients who feel entitled to your time and attention, beyond your scope of work. And there’s a simple solution to this: say NO. Sounds easy, right? Yet many women find it very hard to say this one word. We always want to please people; we always want to help and be of service. And that’s okay, but to an extent. If it’s at your own expense, the time you’d rather spend on yourself or your family, say no.

If it’s late at night, or if it’s the weekend and it’s not an emergency, don’t pick up the phone. Reply to emails on the next working day. Politely decline work that you shouldn’t be doing. And you shouldn’t feel guilty about it. You should respect your time. Because if you can’t set boundaries for yourself, you won’t be able to set boundaries for your clients too.

If you accept a certain behavior once, you’re going to accept it again and again. This also applies to your own kids. If you accept that they can come in anytime and disturb you while you’re working, you teach them that it’s okay to do that. They also need to learn how to cope with boundaries. They have to learn to understand that their parents are not accessible to them anytime. This may not be the kind of parent you want to be, but you’re not doing them and yourself a favor by not teaching them about boundaries.

6. Work and life balance are a matter of perception

Is the perfect work-life balance even possible? First of all, you have to accept that perfection in this case is all a matter of perception. What’s the perfect balance for you? Does it mean equal parts work and personal life? Does your image of work-life balance have to live up to what you see as perfect on social media? Perfection is something we women torture ourselves with. We have this image of what we think our lives and our business should look like. We become unhappy and dissatisfied when we can’t live up to these unrealistic expectations. How you perceive work-life balance has a lot to do about how happy and content you can be, despite your circumstances.

Summing it up

Work-life balance for women is a constant struggle. For one thing, women are held to a different standard when it comes to being in business and being a parent. We’re expected to both be successful in business and be a good mom as well. Another thing is that we also hold ourselves up against the standard of perfection. We want to make everything perfect; we have to be perfect at everything. But really, what we need to accept is that perfection is an illusion. If you can give up being perfect and be at ease with yourself and what you’re doing, you’ll start to feel more at peace. That’s when we can start to find that balance.

Finding that balance in our business is also a challenge for us female entrepreneurs. When you’re only working on one area of your business (and that can be that one area that you like doing or that area that you think need to work the most), you’re not going to make a significant difference to your business. As a business coach for female entrepreneurs, my advice is always this: If you want to strike that balance, you need to be working on all areas, because they are all connected. What you need is a holistic approach. Learn more about it here.

https://powerfulbusinessacademy.com/a-womens-blueprint-to-business-success/

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

Is growing your sales the most challenging and complicated element of your business? I hear you. It’s a broad and complex area, with so many moving parts. What strategy should you use? Which phase should you focus on? Where do you even start? Add to these the many coaches out there who promise you that you can increase your sales quickly if you buy their programs and copy their method. With so much information and misinformation, how do you know which ones will work for you?

As a business coach for women myself, with over 30 years of business experience, I will tell you this: it’s not easy, and you can’t do it quickly. There’s no magic formula, no instant fix. It’s different for every business, and what works for others may not work for you. And you won’t grow your sales by sales increase strategies alone. There are other areas of your business that affect it, such as positioning, pricing, converting leads, and many more.

If you want to truly improve your sales, you need to approach it in a holistic way. That’s what I set out to do when I created “The Women’s Blueprint to a Successful Business.” It’s a system that involves 9 areas of business, plus 54 sub areas, you need to focus on when you’re scaling and growing your business. Yes, that’s a lot of topics! You can learn what all of them are by downloading a copy of the document [here.] – insert opt-in link

And while you can’t drastically increase your sales overnight, there are still some simple and easy things that can help it along. Here are some ideas to help you boost your sales.

1. Pick up the phone and make calls

Having conversations is the most straightforward way to get more sales. Reach out to your leads, contacts, even your family and friends. I understand that sometimes female entrepreneurs don’t like putting themselves out there, or mixing business with personal relationships. But these are just limiting beliefs. Because, really, what is the worst that can happen? The truth is, you can have good sales conversations with people. If you have a good product or service, they will want to hear about it. And if they say no, which happens, of course, you can always move on.

2. Start an inbox conversation

If you work mostly online, you can start an inbox conversation on Facebook, LinkedIn, or Instagram with a direct message. You’ll have a better chance of converting potential clients if you engage them in a meaningful conversation where they can ask you questions, and you can address their objections.

And if it’s a service you sell or a high-price ticket, aim to schedule a call or a meeting with them. This gives a personal approach to selling and will allow you to have a more free-flowing discussion with them.

3. Leave advertising to the experts if you want your sales growth strategies to work

Advertising online is a good way to increase your sales, especially if you’re selling a product. Make the most of your money by leaving it to the experts who know best how to do it. Yes, you may know how to do it yourself, and you may think that you’ll be saving money if you do it yourself, but the fact is you’ll get way better results when you let professionals or agencies handle it for you. They know what image, copy, and strategy to use to have a higher conversion rate.

4. Have a good landing page or sales page

Make sure that your sales page serves you well. Does it look visually appealing? Do you have a payment system in place to make it easier for your clients to make a purchase? Are you able to collect information such as their email address and phone number for follow-up emails or future promotions? These are some factors you need to take note of if you want more sales through your website.

5. Ask for referrals

Although this way is not scalable, getting referrals is another thing you can do to increase your sales. You can create a referral program for your current clients or ask your friends for leads you can connect with. Growing your business with referrals is by far the most favorite method of businesswomen. Because the leads are warm. And they don’t’ need to sell too much to be able to convert.

But like I previously mentioned, this method is not something you will be able to control because this is dependent on other people making referrals. So, don’t rely solely on this and have other strategies in place.

Summing it up

What I’ve learned as a businesswoman and a business coach for women is that it really helps to approach sales from the perspective of serving and being of help to your clients. Don’t just be in it for the money or the quick sale. Because your clients and potential clients will take notice of that. You want your clients to want to work with you and be in business with you. You want them to keep coming back.

Learning how to grow your sales involves a lot of work on many different areas of your business. And these tips I shared only scratch the surface of what you should do to have a sales increase strategy that works. You should also work on the different areas of your business that affect your sales, such as lead generation and growing your audience. A holistic approach will always be the best way not just to boost your sales but grow your business as well.

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women, check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

What was your goal when you created your business branding? Was it to create a good impression? Was it to look high-end so you can attract high-end customers? Or was it to come across as trendy to keep up with the times?

If you’re anything like me, your aim when you were branding your business was to have a brand identity that resonated with your ideal clients. Something that serves not just your target audience but your business goals as well. Something that distinctly represents who you are and distinguishes you from the rest.

Now, how can female entrepreneurs achieve this?

Before anything else, I must point out that branding and positioning work side by side. They must always be compatible. Not only these, your content and sales strategies must also be in line with how you brand and position yourself. It’s never just one area that you need to work on when you want to make a significant difference to your business. You always need to approach it in a holistic way.

The Women’s Blueprint for Business Success is a system you need to implement when you want to scale your business. It involves 9 areas, with a total of 54 subareas. YES, that is a LOT! I never said that growing a business is easy You can download all the areas of the “Women’s Blueprint to Business Success” here to check which areas you are neglecting at the moment.

But while we’re talking about business branding and positioning, let me share with you some tips I’ve found very effective in my many years as a business coach for women.

1. Involve your clients in the branding or rebranding

How can you know for sure that your target clients will love your branding? Simple. Ask them. What do they think of your logo? Which colors are they attracted to? Which images do they prefer? The beauty of social media and online communities is that you can directly interact with your audience and gather their opinions. What’s even better when you involve your clients is that then it becomes something that they feel attached to, something that they love because they’ve helped you create it.

2. Create clear and detailed branding guidelines

What exactly are branding guidelines? It’s a document that contains everything about how you and your brand should be represented. It has:

- Your logo, in different versions (primary, secondary, black and white, and so on) and different formats (JPEG, PNG, PDF, EPS, and others you might need)

- Your colors (RBG, CMYK, PMS, etc.), with descriptions of how each color should be used

- Also your target audience. Who do you want your visual identity to appeal to?

- Images or photos. How do you want them to look?

- Social media banners, if possible.

3. Invest in good designers when you’re branding your business

Your visual identity is extremely important when you’re trying to set yourself apart from your competitors. So, don’t skimp on it. Hire a good designer to help you execute your vision of a logo that perfectly embodies what your business is. Do the same for your website, too. It’s the first thing potential clients look at when they want to check you out. Especially when you’re targeting high-end clients, invest in good designers. Trust me, it’s worth it.

4. Use the right language for your target audience

Branding isn’t just about visuals. The language you use also has a great impact on whether your message comes across to your target audience the way you want it to. And whether they pay attention to you or not. So be mindful of the tone, the style, and the words that you use. You’ll have a much better chance of being heard by your target audience if you speak their language.

5. Be consistent with your branding

When you know exactly how you want to present your business, make sure that you apply it everywhere––on your website, on your social media channels, in your press releases, publications, and all others. Include your logo where you can, use the same colors, use the same fonts. This will let people know it’s you no matter where they see you. And it will create that standard of quality that your clients will learn to expect from you.

6. How you present yourself should match your target audience

As female entrepreneurs, we know firsthand that the way we present ourselves is a critical factor in growing our business. More so if you are the business. Targeting high-end clients? Make sure you look at the part. Want to appeal to more middle-class clients? Try a more casual appearance. Whoever your ideal clients are, be more relatable to them.

7. It’s all about the attitude

In the end, no matter how you dress, how you do your makeup, or what jewelry you wear, if you don’t have the right attitude, it will not make a difference. Your attitude, how you carry yourself, your confidence, are what really shine through. So, pull your shoulders down, keep your chin up, and own it.

8. There’s nothing wrong with targeting the lower end

Yes, we all want to sell those high-price tickets. But if you’re not confident enough yet that you can sell it, it will not work. So, start with low prices. Once you’ve sold that three times, you can raise the price. If you sell that three more times, raise it again. And repeat. Don’t buy into the programs, online courses, or coaches that tell you to always go high-end. You should get accustomed to lower pricing first. Let yourself and your mind grow, and the rest will follow.

9. You can always rebrand or even up to level

If you’re a female entrepreneur trying to scale and grow, there will come a point when your business will evolve. When that time comes when your branding doesn’t fit your business anymore, don’t be afraid to change. Embrace a new look and a new feel. Your business branding should always match your goals and your target audience, whether existing or new. And if you do rebrand or up level, the tips I’ve mentioned above will still be relevant and effective. Keep them in mind.

Summing it up

Branding and positioning for business are about good design. And as in any good design, you should prioritize function over form. As a business coach for women, I always ask my clients: What works? Something may look good but may not resonate with your clients or your goals. And if that’s the case, all that work will be futile.

It’s also about setting yourself apart. Making yourself unique. And your approach to this is also unique to you. Every business is different, after all. There is no formula, no one-size-fits-all. And it’s never about just this one area. What will set you apart and drive your growth doesn’t solely depend on your branding and positioning. There’s planning, sales, mindset, and many other areas that you need to work on for your business to scale and grow. A holistic approach is what you really need. And if you need help with this or any area of your business, you can always reach out to me.

Learn more

My name is Tineke Rensen and I am a business coach for women. I created the system “A Women’s Blueprint for Business Success,” where I work with female entrepreneurs in 9 major areas in their business.

There are many out there who call themselves “business coaches” but have never had their own business. What you need is a business coach who has experience in scaling and growing businesses. And I’ve had plenty. In my 31 years of experience, I’ve become an expert on many areas, and I can help you with whatever topic you need help with. Because it NEVER is about changing just one thing that’ll pivot your business around

If you want to learn more about what makes a good business coach for women, check out this article about the 20 questions you should ask a business coach for female entrepreneurs.

Interested to learn how you can work with me one-on-one to build your one-woman gig to a proper business and double your income within a year? Click here now to schedule a quick 15-minute call with me and get started.

About the author:

Tineke Rensen of Powerful Business Academy has been in business for 31 years. She built an international Outdoor and Survival business from scratch and sold it after 22 years.

Tineke was also a national whitewater kayaking champion.

She now is one of the most all-round business accelerators and mentors you can find. She helps businesswomen to “Scale & Grow, Make More Impact And Work Less.” There are very few topics she cannot help you with in your business. Many people find this hard to believe, but hey, how much do you think you know about scaling businesses if you live it day and night for 31 years?

Tineke created the system “A Women’s Blueprint To Business Success.” She is a multi-awarded serial entrepreneur and is the author of the book “Maximum Business Growth For Women.”

Are you struggling to convert your leads into paying clients as a female entrepreneur?

Do you maybe have a lot of inquiries but no buyers? Do your conversations with potential clients stop when you give them your price? If you’re one of these women, read on as I’ll be sharing some tips and strategies you can use to turn your prospects into paying customers.

Before anything else, I must say again that converting leads is just one of the many areas you should work on when you’re trying to scale and grow your business. Before this area makes a significant difference, you must first have a consistent flow of leads coming in, which will not be possible if you don’t have a big enough audience, or if you don’t know how to target them. So a holistic approach to your business is a must.

We work with “The women’s Blueprint for business Success” which are 9 areas in business you always need to work on. Today we talk about the topic of sales. And specifically, about converting.

With that out there, here are 10 tips to convert your leads into paying clients:

1. Start an inbox conversation with potential clients